- Standard Chartered launches facility for clients to borrow against investments in government bonds purchased through CBK’s DhowCS;

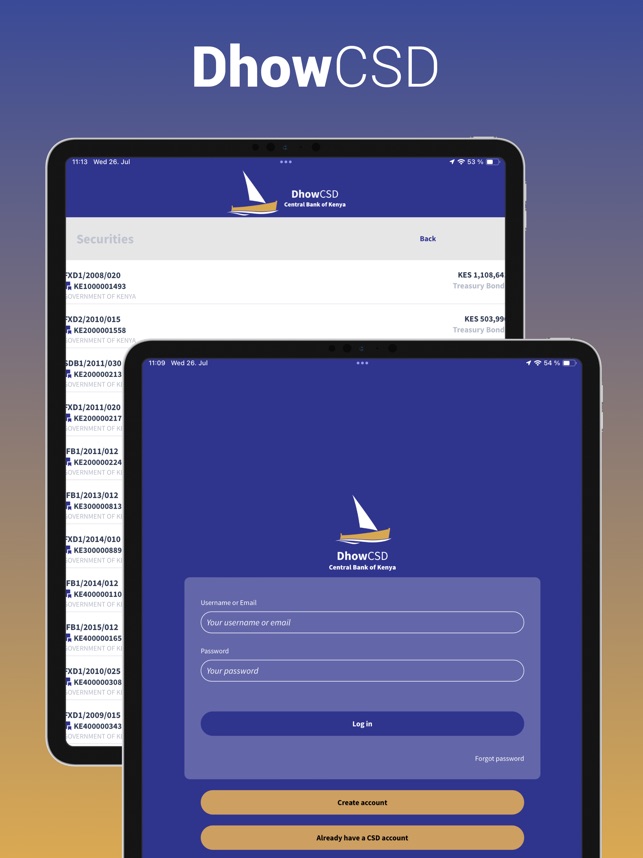

Standard Chartered has launched a new lending facility that allows clients to borrow against their investments in Kenya Government Bonds purchased directly through the Central Bank of Kenya’s (CBK) Dhow Central Securities Depository (DhowCSD) platform.

The facility allows Kenyan resident investors to unlock liquidity from the value of their DhowCSD bond portfolio while continuing to enjoy bi-annual coupon payments.

Loans are offered at a competitive interest rate with no arrangement fees charged. The Bank is targeting affluent clients holding CBK bonds.

Standard Chartered’s Head of Wealth & Retail Banking, Kenya and East Africa Edith Chumba said: “In line with the governments’ agenda to digitise and democratise financial solutions and access for all citizens, we saw an opportunity to extend our Wealth Lending capability to Kenyans who have invested directly with CBK and would require liquidity.

Standard Chartered’s Head of Wealth & Retail Banking, Kenya and East Africa Edith Chumba said: “In line with the governments’ agenda to digitise and democratise financial solutions and access for all citizens, we saw an opportunity to extend our Wealth Lending capability to Kenyans who have invested directly with CBK and would require liquidity.

‘‘Our aim is to help investors unlock the value of their Government Bonds purchased via DhowCSD.

The facility can be used for reinvestment or personal needs, with a minimum loan amount of KES 50,000 and a maximum based on the size of the client’s bond portfolio.”

“The pilot launch earlier this year has been well-received by our clients. A testament that clients value innovation that helps them achieve their financial goals,” added Edith.

The facility is structured as an overdraft, providing flexible repayment terms compared to traditional loans.

According to CBK data, the platform has boosted market participation, with individual investors making up 79% of account holders. The value held by individuals and other non-institutional investors grew from 7% in June 2023 to 13% in June 2024.

DhowCSD has also expanded access to State securities trading, with the number of active accounts rising by 112%, from about 45,000 in July 2023 to over 96,000 by August 2024.

The platform is credited with enhancing operational efficiency, deepening Kenya’s capital markets, and supporting broader financial inclusion.

The platform is credited with enhancing operational efficiency, deepening Kenya’s capital markets, and supporting broader financial inclusion.