Bill Winters, Chief Executive Officer ,Standard Chartered Plc, during a Bloomberg Television interview in London, UK, on Thursday, July 31, 2025. Standard Chartered Plc announced a fresh $1.3 billion share buyback as it reported second-quarter earnings that beat expectations amid the tumult caused by US President Donald Trump's tariff war. Photographer: Jose Sarmento Matos/Bloomberg via Getty Images

- Standard Chartered Deepens Ties in South Africa to Accelerate Africa-Focused Growth;

Standard Chartered Group Chief Executive Bill Winters recently concluded a productive visit to South Africa, a key strategic market for the Bank on the African continent.

The visit underscored Standard Chartered’s unwavering commitment to the region, with Bill expressing optimism about the inherent growth potential across Africa, and particularly within South Africa.

The visit underscored Standard Chartered’s unwavering commitment to the region, with Bill expressing optimism about the inherent growth potential across Africa, and particularly within South Africa.

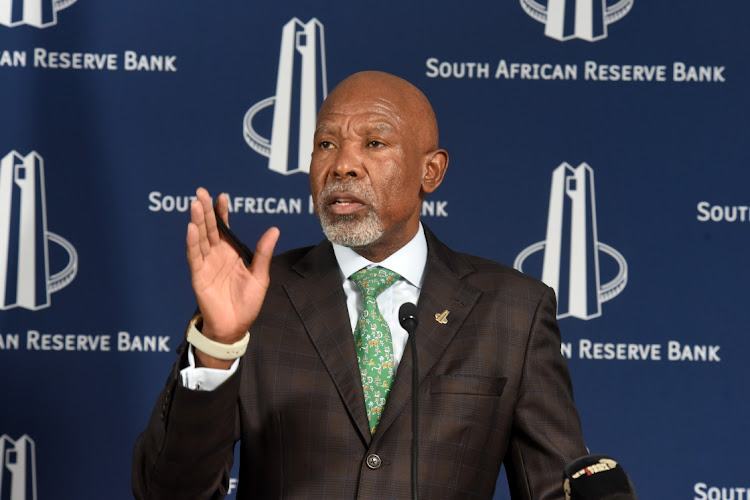

Throughout his visit, he asserted Africa’s investment in strategic partnerships and digital technology to adapt to globalisation, in high-level meetings with key stakeholders, including South African Reserve Bank (SARB) Governor Lesetja Kganyago, prominent clients from various sectors and leading industry CEOs.

Bill Winters, Group Chief Executive of Standard Chartered, said: “. Our unique network and trusted expertise enable us to connect our clients to cross-border opportunities in some of the world’s most dynamic markets. Africa continues to be a key part of our DNA and we’re committed to delivering financial solutions that support economic growth through tangible investment and partnerships.

He further emphasised Standard Chartered’s advantageous position in facilitating cross-border businesses and actively supporting the development and growth of local African banks, thereby strengthening the continent’s financial ecosystem.

He further emphasised Standard Chartered’s advantageous position in facilitating cross-border businesses and actively supporting the development and growth of local African banks, thereby strengthening the continent’s financial ecosystem.

Chris Egberink, CEO and Head of Coverage, Standard Chartered South Africa said: “We aim to be the bridge for South African corporates expanding across Africa and Internationally, and for international clients and investors seeking opportunities in South Africa (and Africa).

Our leading Debt & Capital markets offering, together with our innovative solutions in trade, digital finance, and sustainable investments position us to support our clients’ ambitions across the continent.”

Our leading Debt & Capital markets offering, together with our innovative solutions in trade, digital finance, and sustainable investments position us to support our clients’ ambitions across the continent.”

South Africa’s fintech sector is projected to reach $14.86 billion by 2033 from $7.08 billion in 2023, presenting significant growth opportunities with a projected CAGR of 7.7%.

Standard Chartered is leveraging this expansion through its digital and innovation platforms, including the Straight2Bank platform, which streamlines digital banking for clients by simplifying transactions, account access, payment authorisation, and term loan management.

Standard Chartered is leveraging this expansion through its digital and innovation platforms, including the Straight2Bank platform, which streamlines digital banking for clients by simplifying transactions, account access, payment authorisation, and term loan management.