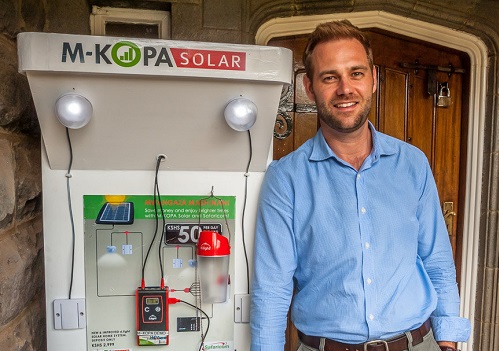

Jesse Moore, Co-Founder & CEO of M-KOPA

- Fintech pioneer deploys $2 billion in credit to Africa’s “Every Day Earners” – micro entrepreneurs invisible to traditional banks //

M-KOPA, Africa’s leading inclusive fintech, has surpassed 3 million active customers for the first time – a milestone that puts the company on track to serve 10 million Every Day Earners by the end of the decade.

The company’s 2025 Impact Report reveals that 9 out of 10 active customers now say M-KOPA has improved their lives, up from 8 out of 10 last year. Since 2011, M-KOPA has reached 7 million total customers and deployed over $2 billion in credit to hardworking micro-entrepreneurs in the informal sector who are typically locked out by traditional financial services.

The company’s 2025 Impact Report reveals that 9 out of 10 active customers now say M-KOPA has improved their lives, up from 8 out of 10 last year. Since 2011, M-KOPA has reached 7 million total customers and deployed over $2 billion in credit to hardworking micro-entrepreneurs in the informal sector who are typically locked out by traditional financial services.

“What matters most to us is how many people we’re actively serving every day, those who stay engaged with us over time. Our active customer number reached 3 million for the first time this year,”said Jesse Moore, Co-Founder & CEO of M-KOPA.

“When we ask customers ‘does M-KOPA make your life better?’ 9 out of 10 say yes. That’s tangible and meaningful impact on millions of lives.”

“When we ask customers ‘does M-KOPA make your life better?’ 9 out of 10 say yes. That’s tangible and meaningful impact on millions of lives.”

M-KOPA serves Every Day Earners – people who make their income daily in Africa’s vast informal sector but remain unseen by conventional financial services designed for salaried workers.

The company addresses a critical gap in Sub-Saharan Africa, where 60% of the population has internet coverage, but only 27% can afford to access it.

The company addresses a critical gap in Sub-Saharan Africa, where 60% of the population has internet coverage, but only 27% can afford to access it.

Since 2020 M-KOPA has enabled 2.5 million first-time smartphone users, with 81% of women customers reporting they couldn’t afford a smartphone without M-KOPA.

For 55% of customers, M-KOPA represents their first access to any formal financial product, while 67% are accessing health insurance for the first time.

For 55% of customers, M-KOPA represents their first access to any formal financial product, while 67% are accessing health insurance for the first time.

Through its “More than a Phone” platform, 70% of customers use their M-KOPA smartphone to generate income and 59% report higher earnings since ownership.

M-KOPA’s approach operates across five interconnected pillars that scale individual inclusion into community transformation:

M-KOPA’s approach operates across five interconnected pillars that scale individual inclusion into community transformation:

- Included:55% accessing their first formal financial product; $2 billion deployed to over 7 million everyday earners

- Connected:5 million first-time smartphone users since 2020; 40% first time smartphone users in 2025 demonstrating affordable access remains critical

- Prosperous:70% use smartphones for income generation; 59% report higher earnings since ownership

- Sustainable: 4,000+ electric motorbikes financed, & 127,700 circular economy products resulting in 46,000 tonnes of CO₂ avoided

- Local Markets:Over 35,000 agents (17% growth), with 57% reporting M-KOPA as their first income opportunity

In 2024, M-KOPA’s local procurement spend totalled $236 million across all markets. Women represent 45% of M-KOPA’s agent network and 40% of all customers, with 86% reporting improved quality of life.

M-KOPA operates across Kenya, Uganda, Ghana, Nigeria and South Africa, and employs over 2,000 full time staff and 35,000 sales agents across the continent.

The company has been recognized by the Financial Times as one of Africa’s Fastest-Growing Companies for four consecutive years and by CNBC as one of the World’s Top Fintech Companies 2025.

The company has been recognized by the Financial Times as one of Africa’s Fastest-Growing Companies for four consecutive years and by CNBC as one of the World’s Top Fintech Companies 2025.

Click here to read the full M-KOPA Impact Report 2025.