- Government issues Kes44.7 Bn infrastructure bond at NSE

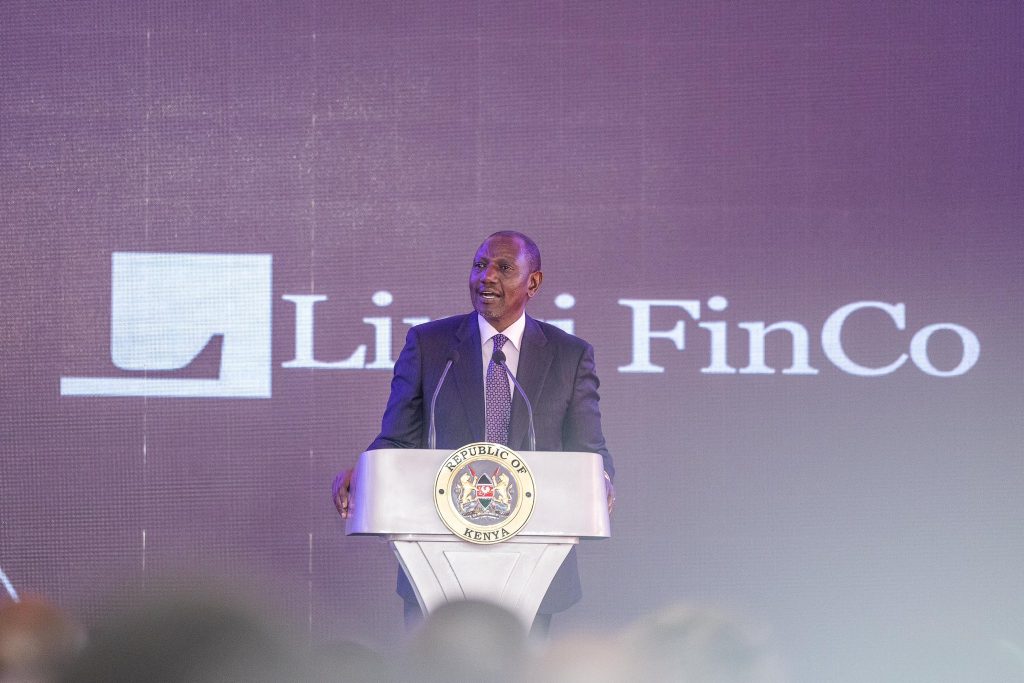

President William Ruto has issued a Sh44.7 billion infrastructure bond at the Nairobi Securities Exchange (NSE), opening the way for the development of Kenya’s biggest stadium project.

The funds, raised by LINZI FinCo Trust and under the Infrastructure Asset-Backed Securities (IABS) programme, will finance the construction of the 60,000-seater Talanta Sports City stadium in Nairobi to host future Africa Cup of Nations (AfCON) matches and other international sporting tournaments.

The funds, raised by LINZI FinCo Trust and under the Infrastructure Asset-Backed Securities (IABS) programme, will finance the construction of the 60,000-seater Talanta Sports City stadium in Nairobi to host future Africa Cup of Nations (AfCON) matches and other international sporting tournaments.

Speaking during the bell-ringing ceremony, Ruto said the listing represents a new dawn for Kenya’s leadership in pursuing infrastructure development through the financial markets.

“It reiterates our belief in market-based financing and demonstrates how we can fund massive infrastructure in a sustainable way through our capital markets,” Ruto stated.

“It reiterates our belief in market-based financing and demonstrates how we can fund massive infrastructure in a sustainable way through our capital markets,” Ruto stated.

The bond, issued by Linzi FinCo 003 Trust in its official capacity, is supported by the future cash-flows of the Sports, Arts and Social Development Fund (SASDF) and guaranteed by an escrow account and standby letter of credit.

The secured notes carry a fixed rate of interest and qualify for tax exemption on income.Qualified investors only, as defined under the Capital Markets Act, are invited to subscribe.

The secured notes carry a fixed rate of interest and qualify for tax exemption on income.Qualified investors only, as defined under the Capital Markets Act, are invited to subscribe.

The President termed the agreement as part of a growing list of off-budget initiatives his government is undertaking in a bid to relieve pressure on public borrowing.

“This feat adds our history-making innovations such as our Government-to-Government (G-to-G) fuel supply program and our asset-backed infrastructure securitization that has raised Sh175 billion off-balance sheet,” he added.

“This feat adds our history-making innovations such as our Government-to-Government (G-to-G) fuel supply program and our asset-backed infrastructure securitization that has raised Sh175 billion off-balance sheet,” he added.

Talanta Sports City will be the country’s first stadium built for its capacity since the Moi International Sports Centre, Kasarani.

The project not only aims to meet international standards but also to change the sporting infrastructure in the country at large.

Ruto also noted of the broader significance of the bond, deeming it a reflection of the financial maturity of the nation.

Ruto also noted of the broader significance of the bond, deeming it a reflection of the financial maturity of the nation.

“It not only points to deeper capital markets, but also to the innovation and maturity driving the country’s financial solutions,” he stated.

The structuring of the IABS was undertaken by a consortium comprising Liaison Financial Services, KCB Investment Bank, CPF Capital, Ernst & Young, and KN Law LLP – all of whom ensured that the offering was compliant with the prevailing regulations while protecting the interests of investors.

The structuring of the IABS was undertaken by a consortium comprising Liaison Financial Services, KCB Investment Bank, CPF Capital, Ernst & Young, and KN Law LLP – all of whom ensured that the offering was compliant with the prevailing regulations while protecting the interests of investors.

“This is a reflection of new energy, sound leadership, and strategic direction,” he said.