- Kenya’s Insurance Industry Cracks Down on Fraudulent Motor Policies;

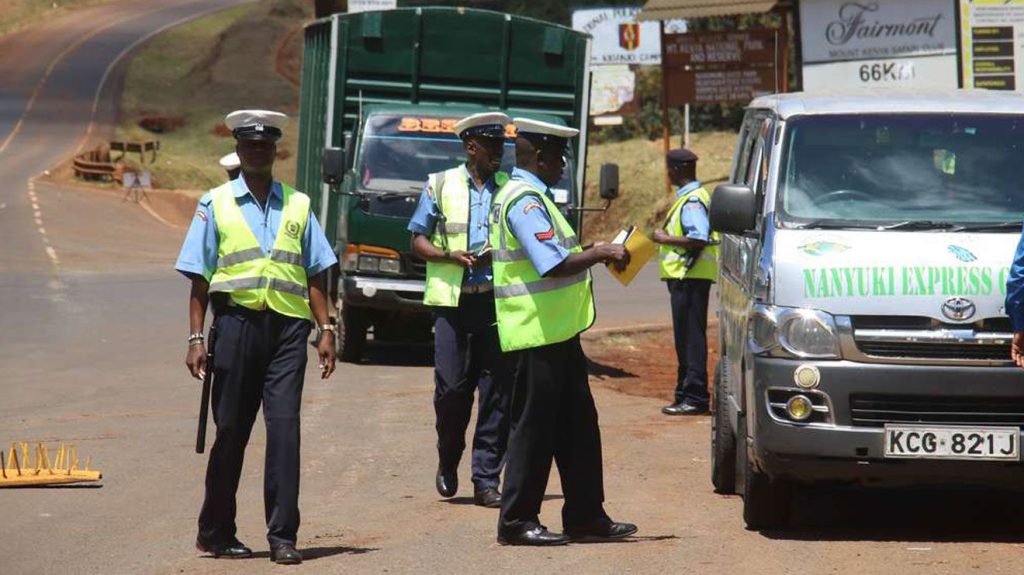

The Association of Kenya Insurers (AKI), in collaboration with the Traffic Police, the Insurance Regulatory Authority (IRA), and the Insurance Fraud Investigation Unit, has intensified enforcement against fraudulent motor insurance certificates, uncovering 44 cases across two regions during 2025.

AKI has rolled out digitized motor insurance certificates as part of efforts to simplify access and strengthen verification. Despite these measures, forged policies remain a concern, constituting a criminal offence under Kenyan law.

AKI has rolled out digitized motor insurance certificates as part of efforts to simplify access and strengthen verification. Despite these measures, forged policies remain a concern, constituting a criminal offence under Kenyan law.

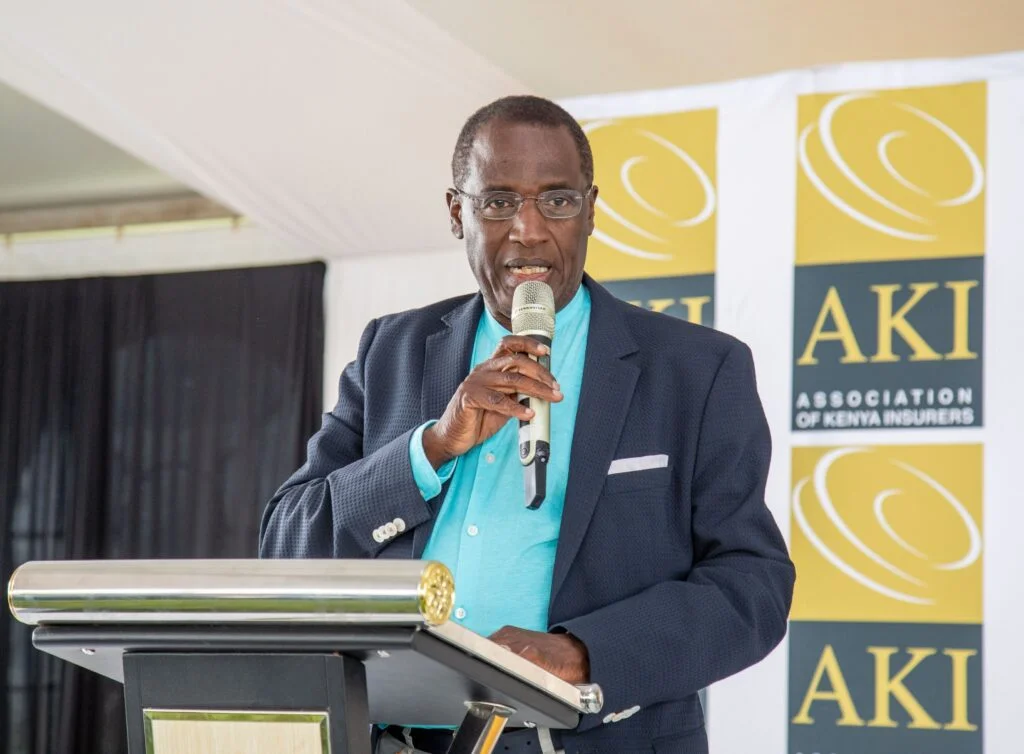

“Digitization has significantly strengthened verification, but enforcement remains critical,” said AKI Executive Director Tom Gichuhi.

“Digitization has significantly strengthened verification, but enforcement remains critical,” said AKI Executive Director Tom Gichuhi.

“Fraudulent motor insurance certificates offer no protection to motorists and undermine public confidence in the sector.”

Enforcement Operations

Enforcement Operations

In June 2025, an operation in the Central region, led by Commissioner of Police Anthony Muriithi, uncovered 27 instances of fraudulent motor insurance certificates.

Four cases have been concluded, with offenders receiving fines ranging from KES 15,000 to KES 30,000 or prison terms of four months to one year. The remaining cases are pending in court.

Four cases have been concluded, with offenders receiving fines ranging from KES 15,000 to KES 30,000 or prison terms of four months to one year. The remaining cases are pending in court.

A subsequent operation in December in the Coast region identified 17 additional cases.Three of these have been finalised:

A subsequent operation in December in the Coast region identified 17 additional cases.Three of these have been finalised:

one offender was fined KES 200,000 or faced two years’ imprisonment, while two others were fined KES 50,000 or served six-month jail terms.

AKI has warned that fraudulent motor insurance certificates pose both financial and reputational risks for the industry while leaving motorists unprotected.

AKI has warned that fraudulent motor insurance certificates pose both financial and reputational risks for the industry while leaving motorists unprotected.

Ongoing Measures and Consumer Guidance

Ongoing Measures and Consumer Guidance

Gichuhi emphasized that AKI will continue working closely with law enforcement to safeguard consumers and uphold the integrity of the insurance sector.

The association plans to extend joint enforcement operations to other regions, ensuring that digitisation translates into tangible protection for policyholders.

Motorists are urged to verify the authenticity of their motor insurance certificates using AKI’s USSD code *352# or the Bima Yangu mobile application, and to avoid purchasing insurance from unauthorised agents or brokers.

Motorists are urged to verify the authenticity of their motor insurance certificates using AKI’s USSD code *352# or the Bima Yangu mobile application, and to avoid purchasing insurance from unauthorised agents or brokers.

Through these measures, Kenya’s insurance industry aims to protect policyholders, strengthen sector integrity, and maintain public trust as digital solutions reshape the market.

Through these measures, Kenya’s insurance industry aims to protect policyholders, strengthen sector integrity, and maintain public trust as digital solutions reshape the market.