The Government has launched the Kenya Pipeline Company Limited (KPC) Initial Public Offering (IPO) at the Nairobi Securities Exchange (NSE), marking Kenya’s largest IPO and the country’s first fully electronic public offer.

The transaction offers 65 per cent of KPC’s issued ordinary shares to the public at KSh 9.00 per share, opening ownership of one of Kenya’s most strategic energy infrastructure assets to local, regional, and international investors. It is also the Government’s first state led market listing in 17 years, following the Safaricom IPO of 2008.

The transaction offers 65 per cent of KPC’s issued ordinary shares to the public at KSh 9.00 per share, opening ownership of one of Kenya’s most strategic energy infrastructure assets to local, regional, and international investors. It is also the Government’s first state led market listing in 17 years, following the Safaricom IPO of 2008.

The IPO is anchored in the Government’s economic agenda to strengthen macro economic stability, reduce pressure on taxpayers, and de-risk public investments through market-based reforms.

The IPO is anchored in the Government’s economic agenda to strengthen macro economic stability, reduce pressure on taxpayers, and de-risk public investments through market-based reforms.

Proceeds will be applied within the national budget framework as seed capital for priority infrastructure, strategic investments, and fiscal consolidation.

Supported by KPC’s strong fundamentals,revenues of KSh 38.6 billion and after tax profits of KSh 10.37 billion for the year ended 30 June 2025,and its 1,300-kilometre pipeline network, the offer represents a decisive step in transforming a profitable state enterprise into a people owned company while strengthening longterm economic resilience.

Supported by KPC’s strong fundamentals,revenues of KSh 38.6 billion and after tax profits of KSh 10.37 billion for the year ended 30 June 2025,and its 1,300-kilometre pipeline network, the offer represents a decisive step in transforming a profitable state enterprise into a people owned company while strengthening longterm economic resilience.

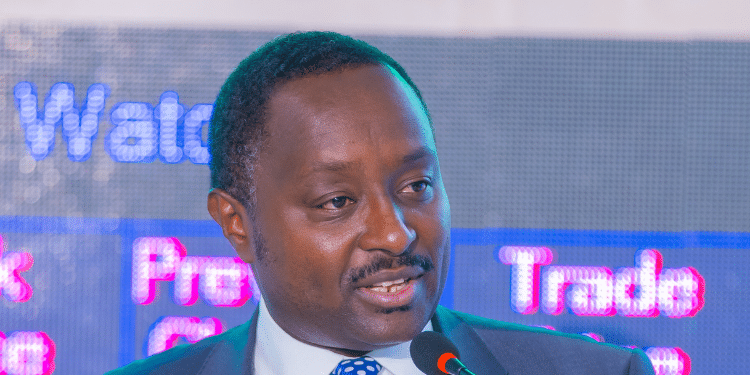

The transaction has been spearheaded by the National Treasury under the leadership of John Mbadi Ng’ongo, working closely with regulators and market institutions to ensure transparency, strong governance, and broad public participation.

The transaction has been spearheaded by the National Treasury under the leadership of John Mbadi Ng’ongo, working closely with regulators and market institutions to ensure transparency, strong governance, and broad public participation.

Speaking when he presoded over the launch, the Cabinet Secretary said the IPO signals a renewed commitment to deepening Kenya’s capital markets as a central pillar of economic growth, noting that well-functioning markets mobilise capital, attract investment, and strengthen market institutions.

He framed the IPO as asset optimisation rather than asset disposal, converting part of a concentrated public equity holding into diversified national capital to support growth across multiple sectors.

He framed the IPO as asset optimisation rather than asset disposal, converting part of a concentrated public equity holding into diversified national capital to support growth across multiple sectors.

The transaction also aligns with public calls during the 2025/2026 Finance Bill consultations for development financing approaches that reduce reliance on excessive borrowing.

Proceeds will provide seed capital for the National Infrastructure Fund, supporting investments in energy, roads, water, airports, and other strategic sectors. The launch was attended by Principal Secretaries

Chris Kiptoo (National Treasury), Cyrell Odede (Public Investment and Asset Management), Hassan Abubakar (Investment Promotion), and Mohammed Liban (Petroleum), alongside KPC CEO Joe Sang, Privatisation Authority Managing Director Dr. Janerose Omondi, PIPM Director-General Lawrence Kibet, Chairman and other senior Government and market stakeholders.

Chris Kiptoo (National Treasury), Cyrell Odede (Public Investment and Asset Management), Hassan Abubakar (Investment Promotion), and Mohammed Liban (Petroleum), alongside KPC CEO Joe Sang, Privatisation Authority Managing Director Dr. Janerose Omondi, PIPM Director-General Lawrence Kibet, Chairman and other senior Government and market stakeholders.

Kenya Pipeline Company Limited (“KPC”) is undertaking an Initial Public Offering (“IPO”) in which 65% of its ordinary shares is being offered to the public and will be listed on the Main Investment Market Segment of the Nairobi Securities Exchange.

This Offer provides investors with an opportunity to participate in the ownership of a strategically important national and regional petroleum infrastructure company that plays a critical role in Kenya’s energy supply chain.

Key IPO Details:

Key IPO Details:

- Issuer: Kenya Pipeline Company Limited (KPC)

- Total number of Offer Shares: 11,812,644,350

- Offer Price per Share: KShs. 9.00

- Par value of each Offer Share: KShs 0.02

- Use of Proceeds:Gross proceeds of approximately KSHS 106,313,799,150 (assuming full subscription) will form part of the Government’s approved financing plan for the 2025/26 financial year and will be applied in accordance with the national budget framework and the fiscal policy direction.

The resources shall be allocated to critical commercially viable infrastructure investment priorities, specifically Energy, Roads, Water and Irrigation, Airports.

The resources shall be allocated to critical commercially viable infrastructure investment priorities, specifically Energy, Roads, Water and Irrigation, Airports.

- Listing: Nairobi Securities Exchange (NSE)

- Minimum number of application shares: 100 shares

- Lead Transaction Adviser: Faida Investment Bank Limited