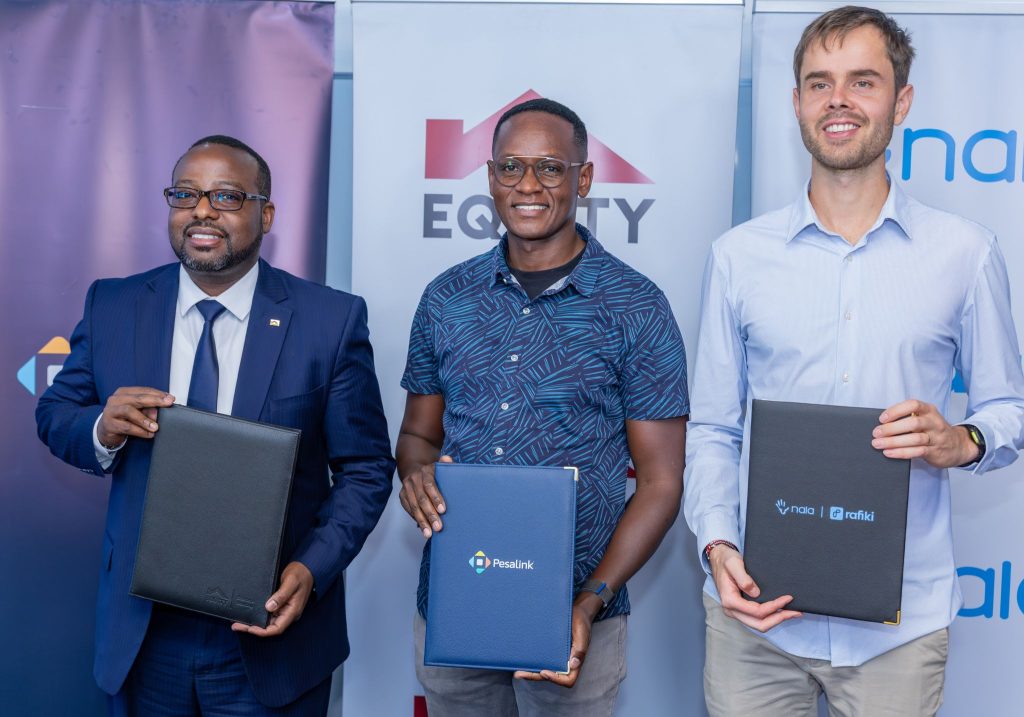

Pesalink, NALA, and Equity Bank are partnering to transform cross-border payments in Kenya, making it faster, more reliable, and more accessible for Kenyans living abroad.

With diaspora remittances to Kenya reaching a record US$4.94 billion in 2024, these inflows have become a vital source of foreign exchange.

The collaboration allows senders in the US, UK, and Europe to use the NALA app to transfer funds via debit card or bank account, with recipients receiving money in near real-time directly into mobile wallets or bank accounts.

Samuel Ireri, PSM1, Equity Group Head of International Banking & Payments, describes the partnership as a strategic move aligned with Equity Group’s Africa Recovery and Resilience Plan to drive inclusive economic growth across the continent.

Samuel Ireri, PSM1, Equity Group Head of International Banking & Payments, describes the partnership as a strategic move aligned with Equity Group’s Africa Recovery and Resilience Plan to drive inclusive economic growth across the continent.

By combining NALA’s user-friendly platform, PesaLink’s real-time capabilities, and Equity Bank’s settlement infrastructure, remittance flows are being digitized to expand access for underserved communities.

This partnership routes transfers through PesaLink’s instant payment network, eliminating intermediaries.PesaLink supports instant account-to-account transfers up to Ksh 999,999 across over 80 participants, including banks, SACCOs, telcos, and fintech firms.

This partnership routes transfers through PesaLink’s instant payment network, eliminating intermediaries.PesaLink supports instant account-to-account transfers up to Ksh 999,999 across over 80 participants, including banks, SACCOs, telcos, and fintech firms.

Kenn Lisudza, Chief Products Officer at IPSL, notes that removing friction from cross-border payments drives inclusion and reliability for millions of Kenyans.

For diaspora communities, the NALA app ensures money arrives almost instantly, supporting everyday financial planning for families and businesses.

Fintechs and remittance companies also gain from access to PesaLink’s trusted infrastructure and richer payment data, which supports reconciliation and creates a stronger foundation for Kenya’s economy.

Nicolai Eddy, COO of NALA, emphasizes that billions are lost annually to cross-border payment fees worldwide. By choosing the right infrastructure partners, NALA aims to reduce fees and make cross-border payments faster, more reliable, and affordable for everyone.

Nicolai Eddy, COO of NALA, emphasizes that billions are lost annually to cross-border payment fees worldwide. By choosing the right infrastructure partners, NALA aims to reduce fees and make cross-border payments faster, more reliable, and affordable for everyone.