Eric Muriuki,CEO,LOOP DFS

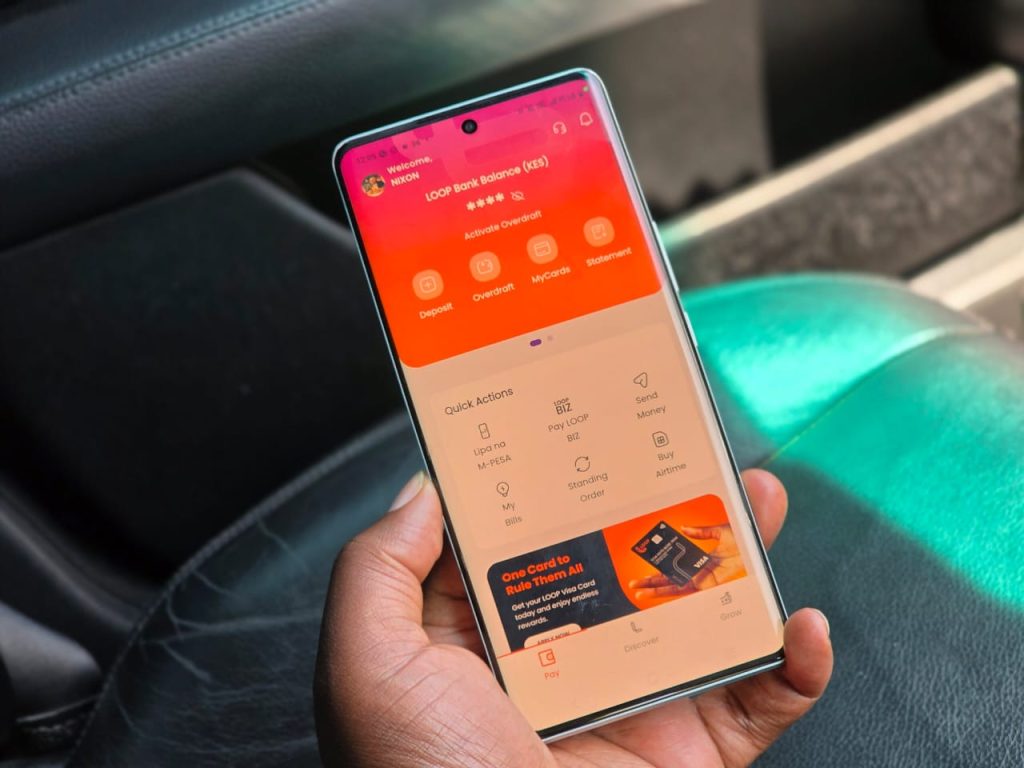

LOOP – a Pan African lifestyle brand anchored on finance – has launched LOOP FLEX, an innovative Buy Now, Pay Later (BNPL) credit facility, that gives customers more flexibility and control over how they shop and pay.

With LOOP FLEX, customers can acquire goods on credit by making a minimum deposit of 10%, while LOOP settles the full purchase amount directly to the merchant.

With LOOP FLEX, customers can acquire goods on credit by making a minimum deposit of 10%, while LOOP settles the full purchase amount directly to the merchant.

The balance is then repaid in convenient monthly installments over a flexible period of up to 12 months, with interest applied on the loan amount.

Customers will enjoy FLEX credit limits of a minimum of KES.15,000 and a maximum of KES.1,000,000, enabling them to manage both essential and aspirational purchases with greater ease. Eligibility requires customers to be fully registered on LOOP, to have been assigned a positive LOOP FLEX limit, to hold no overdue loans, and to accept the terms and conditions.

Customers will enjoy FLEX credit limits of a minimum of KES.15,000 and a maximum of KES.1,000,000, enabling them to manage both essential and aspirational purchases with greater ease. Eligibility requires customers to be fully registered on LOOP, to have been assigned a positive LOOP FLEX limit, to hold no overdue loans, and to accept the terms and conditions.

Speaking about the new product release, Eric Muriuki, CEO of LOOP DFS, said: “LOOP FLEX supports our role as a lifestyle enabler, and is designed to give our customers the power to enjoy life while responsibly managing their tomorrow.

Speaking about the new product release, Eric Muriuki, CEO of LOOP DFS, said: “LOOP FLEX supports our role as a lifestyle enabler, and is designed to give our customers the power to enjoy life while responsibly managing their tomorrow.

With this product, therefore, we are reimagining how our customers experience smarter, more flexible financial solutions while at the same time we inspire confidence, empower them to unlock opportunities, and fit seamlessly into the way they live their lives without unnecessary limits. “

With this product, therefore, we are reimagining how our customers experience smarter, more flexible financial solutions while at the same time we inspire confidence, empower them to unlock opportunities, and fit seamlessly into the way they live their lives without unnecessary limits. “

Repayments are structured monthly, with a minimum loan amount of KES.9,000 and the ability for customers to hold up to five active FLEX loans at any given time.

The product is offered on risk-based pricing in line with LOOP’s pricing matrix, supported by a facility fee of 4% of the disbursed amount, plus the applicable excise duty.

The product is offered on risk-based pricing in line with LOOP’s pricing matrix, supported by a facility fee of 4% of the disbursed amount, plus the applicable excise duty.

The model ensures both affordability and responsible lending, while giving customers full transparency on the cost of their loan.

The launch of LOOP FLEX marks a significant milestone for LOOP as it strengthens its position as the go-to lifestyle brand leveraging technology to offer financial solutions that are flexible and convenient.

The launch of LOOP FLEX marks a significant milestone for LOOP as it strengthens its position as the go-to lifestyle brand leveraging technology to offer financial solutions that are flexible and convenient.