- Lobbies Fight New Solar Tax proposed in Finance bill 2025;

GOGLA and Kenya Renewable Energy Association (KEREA) have urged lawmakers to maintain VAT exemptions on solar equipment in the 2025 Finance Bill.

The lobbies argue that the proposed 16 percent VAT on solar equipment under Finance Bill 2025 would cause the price of a typical off-grid solar home system, used by millions of Kenyan families, to increase by sh 2,000.

GOGLA, the global association for the off-grid solar industry,said the tax hike risks shrinking Kenya’s off-grid solar market by 20 percent in the next 12 months.

GOGLA, the global association for the off-grid solar industry,said the tax hike risks shrinking Kenya’s off-grid solar market by 20 percent in the next 12 months.

This would represent a significant setback for electricity access, particularly for remote and underserved communities, effectively erasing a decade of progress.

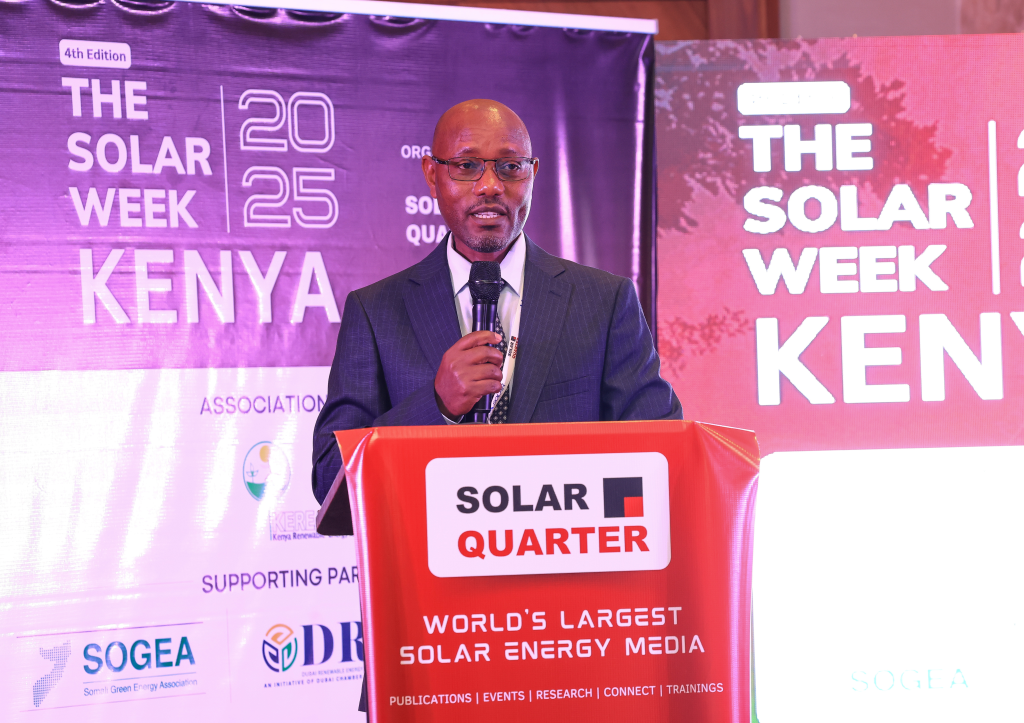

Patrick Tonui, Head of Policy and Regional Strategy at GOGLA,said this is not merely a theoretical concern.

Patrick Tonui, Head of Policy and Regional Strategy at GOGLA,said this is not merely a theoretical concern.

“When VAT exemptions were previously withdrawn in 2020 and 2021, the off-grid solar market contracted by 20 percent.

Reintroducing VAT now risks repeating that experience — dampening demand, reducing tax revenues, and making solar less accessible for the households and enterprises that need it most,” he said.

Cynthia Angweya-Muhati, CEO of the Kenya Renewable Energy Association (KEREA) emphasized that Kenya has made strong progress in expanding energy access, especially in underserved regions.

Cynthia Angweya-Muhati, CEO of the Kenya Renewable Energy Association (KEREA) emphasized that Kenya has made strong progress in expanding energy access, especially in underserved regions.

“Electrification in these regions remains well below the national average, with some counties as low as 15 percent.

Reintroducing VAT could make solar unaffordable for those who need it most and risk slowing progress toward universal access,” Muhati noted.

Reintroducing VAT could make solar unaffordable for those who need it most and risk slowing progress toward universal access,” Muhati noted.