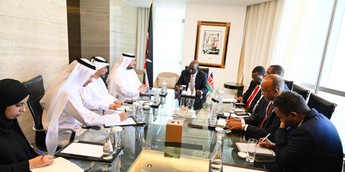

From Left:CBUAE Governor Khaled Mohamed Balama,and CBK Governor Dr.Kamau Thugge

The Central Bank of Kenya (CBK) and the Central Bank of the United Arab Emirates (CBUAE) have signed two Memoranda of Understanding (MoUs) to enhance the use of local currencies in cross-border trade and strengthen payment and messaging systems.

The signings, by CBUAE Governor Khaled Mohamed Balama and CBK Governor Kamau Thugge, mark a significant milestone in financial cooperation between the two countries. Under the first MoU, both central banks will encourage the use of local currencies for commercial transactions.

Under the first MoU, both central banks will encourage the use of local currencies for commercial transactions.

The second MoU focuses on improving payment systems, including the potential integration of instant payment networks and national card switches, subject to regulatory requirements.

Governor Balama emphasized that the agreements reflect the strong economic relationship between the UAE and Kenya.

“The use of local currencies in settling cross-border transactions, coupled with cooperation in linking instant payment systems, will broaden investment and commercial opportunities for both nations,” he stated.

He added that this collaboration paves the way for greater cooperation in the financial and banking sectors, expressing optimism about working closely with Kenya to strengthen financial stability and achieve mutual interests.

He added that this collaboration paves the way for greater cooperation in the financial and banking sectors, expressing optimism about working closely with Kenya to strengthen financial stability and achieve mutual interests.

Dr. Kamau Thugge highlighted the long-standing economic and cultural ties between Kenya and the United Arab Emirates.

“Our people have always traded between themselves, and this has only strengthened in recent years,” he noted.

Dr. Thugge expressed confidence that the MoUs will further cement these ties, ensuring both countries forge ever-closer links in the financial and banking sectors in a scalable and sustainable manner.

The deal is expected to lower transaction costs, improve cross-border payment efficiency, and accelerate financial innovation.

“The interlinking of our two countries’ payment systems will yield tangible benefits for both our citizens and investors in the two countries,” said Thugge.