- Kenya Targets $2 Billion in Deals at KIICO 2026;

Kenya is targeting at least $2 billion (Sh257.9 billion) in bankable investment deals at the fourth Kenya International Investment Conference (KIICO 2026), as the government intensifies efforts to boost foreign direct investment and position the country as Africa’s leading investment hub.

With 53 days to the conference, scheduled for March 25–27 in Nairobi, senior government officials said KIICO 2026 will focus on converting investor interest into signed contracts and closed transactions.

With 53 days to the conference, scheduled for March 25–27 in Nairobi, senior government officials said KIICO 2026 will focus on converting investor interest into signed contracts and closed transactions.

The event will be held alongside the COMESA Investment Forum and the Africa Green Industrialization Initiative Forum.

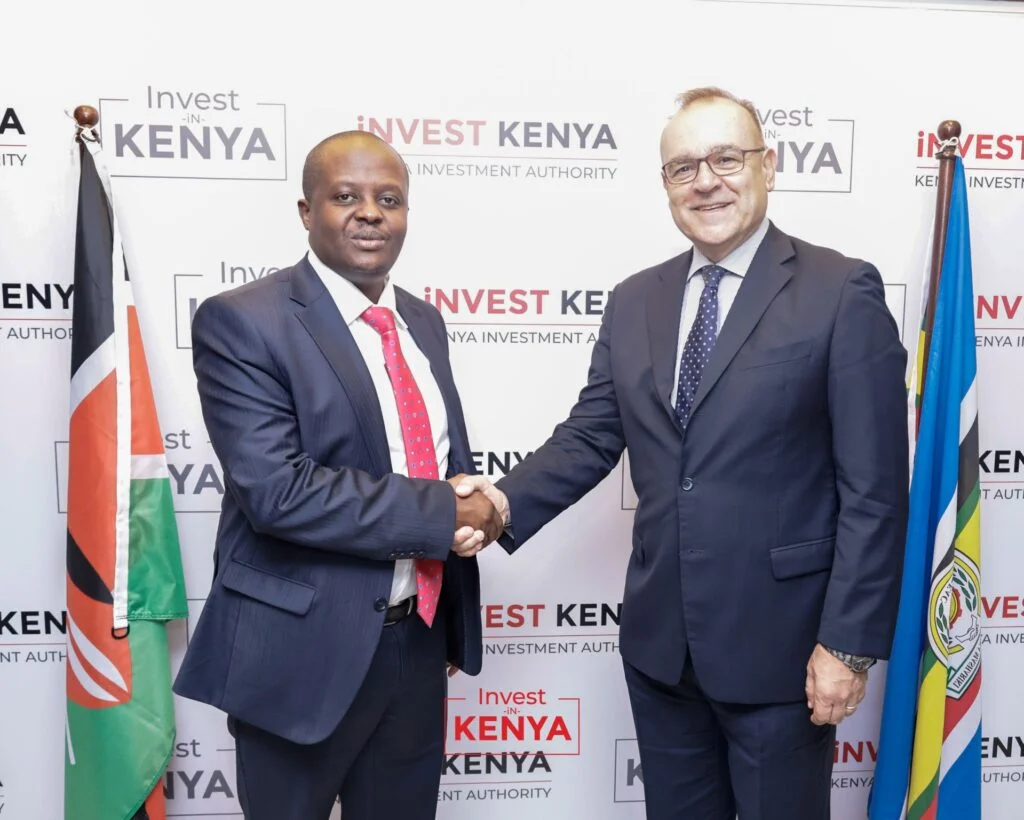

Speaking during a media briefing, Principal Secretary for Investment Abubakar Hassan said the conference marks a shift from promotional dialogue to execution-driven outcomes.

Speaking during a media briefing, Principal Secretary for Investment Abubakar Hassan said the conference marks a shift from promotional dialogue to execution-driven outcomes.

“KIICO 2026 will not be a talk show. That’s a promise,” Hassan said. “It will be a platform of commitment, execution, and measurable impact.”

The government aims to use the conference to support its broader goal of more than doubling annual FDI inflows in the short term, amid tightening global capital flows and growing competition among emerging markets.

The government aims to use the conference to support its broader goal of more than doubling annual FDI inflows in the short term, amid tightening global capital flows and growing competition among emerging markets.

Hassan said the investment push is anchored in reforms undertaken over the past three years, including nearly 100 business-enabling interventions to improve the ease of doing business.

Hassan said the investment push is anchored in reforms undertaken over the past three years, including nearly 100 business-enabling interventions to improve the ease of doing business.

A further 33 measures are contained in the proposed Business Laws (Amendment) Bill 2026, expected to be passed by Parliament in March.

A further 33 measures are contained in the proposed Business Laws (Amendment) Bill 2026, expected to be passed by Parliament in March.

“It will be a platform of not conversation, but conversion,” Hassan said. “Not leads, but actual deals. Not getting contacts, but getting actual contracts.”

Kenya Investment Authority (KenInvest) Chief Executive Officer John Mwendwa said Africa attracted approximately $100 billion in foreign direct investment in 2024, emphasizing the scale of competition for capital.

Kenya Investment Authority (KenInvest) Chief Executive Officer John Mwendwa said Africa attracted approximately $100 billion in foreign direct investment in 2024, emphasizing the scale of competition for capital.

Noting that Kenya has ranked first in Africa for startup funding in last three consecutive years, raising over $1 billion, and continues to perform strongly in regional competitiveness indices.

Mwendwa added that Kenya’s value proposition extends beyond policy reforms to market access. Investors operating from Kenya can reach a domestic and regional market of between 55 and 60 million consumers through existing trade agreements, with further expansion expected as new partnerships are concluded.

Mwendwa added that Kenya’s value proposition extends beyond policy reforms to market access. Investors operating from Kenya can reach a domestic and regional market of between 55 and 60 million consumers through existing trade agreements, with further expansion expected as new partnerships are concluded.

Data from KenInvest show recent investment projects have been concentrated in renewable energy, communications, electronic components, manufacturing, agriculture, and fossil fuels, sectors viewed as critical for industrial growth, energy transition, and value addition.

A key policy signal highlighted at the briefing was the launch of the Kenya Digital One-Stop Centre (services.investkenya.go.ke), a platform that allows investors to process company registration, tax compliance, licensing, work permits, and advisory services through a single digital interface.

“Imagine a situation where you just log in and obtain all the services you require,” a KenInvest official said during a live demonstration, pointing to efforts to reduce approval timelines and bureaucratic delays.

“Imagine a situation where you just log in and obtain all the services you require,” a KenInvest official said during a live demonstration, pointing to efforts to reduce approval timelines and bureaucratic delays.

The government has also launched a $40 million Green Investment Fund aimed at de-risking climate-friendly projects and co-investing with the private sector.

The government has also launched a $40 million Green Investment Fund aimed at de-risking climate-friendly projects and co-investing with the private sector.

“We have put our skin in the game,” Hassan said, adding that the fund will support renewable energy, sustainable manufacturing, and green infrastructure projects.

Officials said aligns with the government’s Bottom-Up Economic Transformation Agenda(BETA), reflecting a shift from public financing toward private investment-led growth.

Officials said aligns with the government’s Bottom-Up Economic Transformation Agenda(BETA), reflecting a shift from public financing toward private investment-led growth.

The conference is expected to bring together policymakers, domestic and international investors, and development partners, with officials positioning it as a repeatable investment marketplace rather than a one-off promotional event.

The conference is expected to bring together policymakers, domestic and international investors, and development partners, with officials positioning it as a repeatable investment marketplace rather than a one-off promotional event.