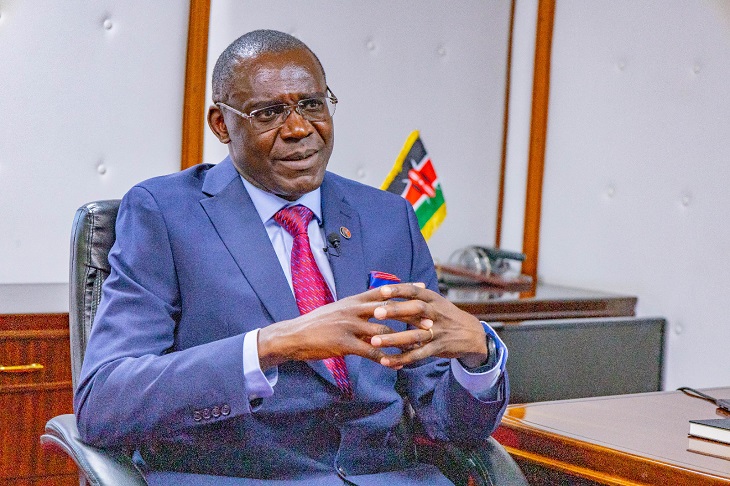

George Obell, Commissioner of Medium and Small Taxpayers,Kenya Revenue Authority (KRA)

The Kenya Revenue Authority (KRA) is leveraging digital reforms to make value-added tax (VAT) the country’s leading source of revenue.

George Obell, Commissioner of Medium and Small Taxpayers, used the case of Kenya’s electronic Tax Invoice Management System (eTIMS), a platform that has significantly boosted VAT compliance, reduced fraud, and enhanced revenue performance.

eTIMS has enabled real-time tracking of transactions and automated enforcement to support KRA in the identification and blocking of fictitious claims and counterfeit invoices.

eTIMS has enabled real-time tracking of transactions and automated enforcement to support KRA in the identification and blocking of fictitious claims and counterfeit invoices.

During the African Development Bank VAT Digitization Seminar in Nairobi, Obell said the VAT system in Kenya is being revolutionized.

“Our ambition is to have VAT as the most reliable and highest-revenue taxhead.VAT is paid by consumers, companies are mere agents. When the system is exploited, it is the government and the public who lose,” he stated.

“Our ambition is to have VAT as the most reliable and highest-revenue taxhead.VAT is paid by consumers, companies are mere agents. When the system is exploited, it is the government and the public who lose,” he stated.

Obell noted that the traders will no longer have to jump through hoops, they just click and file.

VAT local collection during the 2023/25 FY rose to Sh314.157 billion from a similar period during the 2022/23 FY, following the introduction of eTIMS.

However, customs revenue surpassed VAT collection at Sh791.368 billion in the period.

In February 2025 ,the Taxman upgraded the Electronic Tax Invoice Management System (eTIMS) platform.This was an effort to improve the taxpayer experience and simplify taxpayer services.

For Instance,Taxpayers using eTIMS Client as their primary invoicing solution can now add the online portal as a secondary invoicing option and vice versa.

For Instance,Taxpayers using eTIMS Client as their primary invoicing solution can now add the online portal as a secondary invoicing option and vice versa.

This change eliminates the need for KRA’s approval to facilitate change of devices or solutions. eTIMS now allows taxpayers to access all invoices generated from different eTIMS solutions such as eTIMS Client, System to System integration solutions (VSCU & OSCU) and the eCitizen portal through the online taxpayer portal.