- Revocation of PAYU Kenya Limited Authorisation;

The Central Bank of Kenya (CBK) has revoked the authorisation of PayU Kenya Limited (PayU) as a licensed Payment Service Provider (PSP).

This is after PayU made an official application to voluntarily cease business operations in Kenya. PayU was licensed by CBK to operate as a PSP on March 23, 2023.

This is after PayU made an official application to voluntarily cease business operations in Kenya. PayU was licensed by CBK to operate as a PSP on March 23, 2023.

The decision to cease operations in Kenya was made by the PayU Board of Directors, pursuant to an informed consideration and review of its strategic plan as a business enterprise going forward.

The revocation, effective October 13, 2025, was signed by CBK Governor Dr. Kamau Thugge formally ending the firm’s authorization to provide payment services in Kenya.

PayU Kenya, a subsidiary of Netherlands-based PayU, began operations in 2019 through a partnership with African payments company Cellulant.

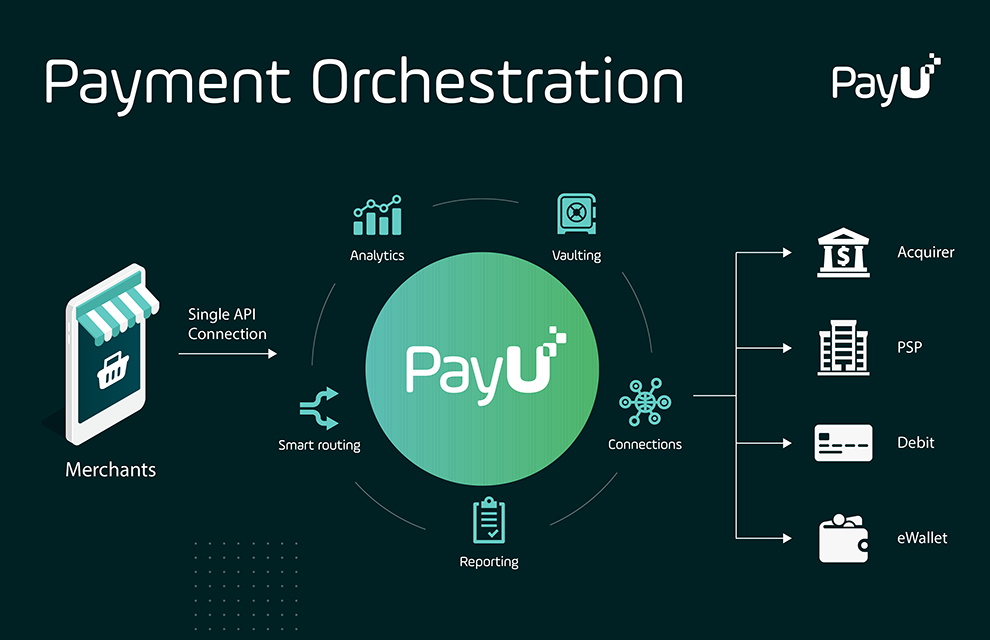

It offered digital payment gateway services that integrated card payments, bank transfers, and mobile money wallets for online merchants. The company positioned itself as a bridge between global e-commerce firms and East Africa’s fragmented payment systems.

PayU remains active in other African markets, including Nigeria and South Africa, where it continues to operate under local regulatory frameworks.

Consequently, PayU has adhered to all the legal and regulatory requirements related to the cessation of business operations, including the payment of funds owed to customers of PayU.

Consequently, PayU has adhered to all the legal and regulatory requirements related to the cessation of business operations, including the payment of funds owed to customers of PayU.

Following the exit of PayU from Kenya and pursuant to Section 15 of the National Payment System Act, 2011, and Regulation 10 of the National Payment System Regulations, 2014, the public is hereby notified that PayU will no longer conduct the business of a payment service provider in Kenya.

Following the exit of PayU from Kenya and pursuant to Section 15 of the National Payment System Act, 2011, and Regulation 10 of the National Payment System Regulations, 2014, the public is hereby notified that PayU will no longer conduct the business of a payment service provider in Kenya.

CBK remains committed to ensuring the safety, stability, integrity and efficiency of the payment ecosystem in Kenya.

CBK remains committed to ensuring the safety, stability, integrity and efficiency of the payment ecosystem in Kenya.