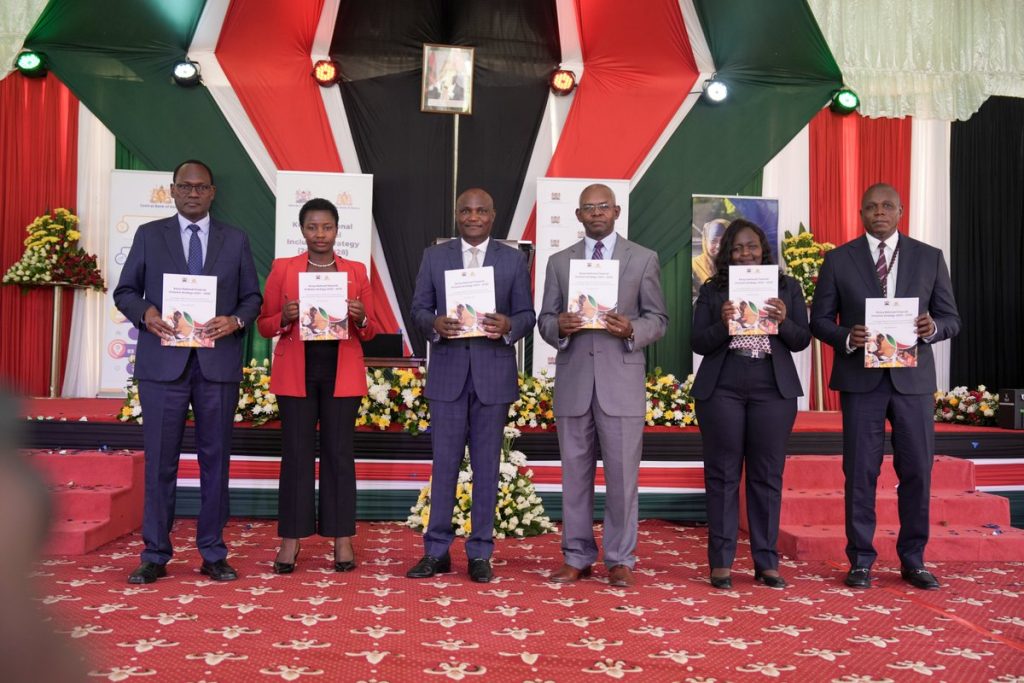

- Launch of National Financial Inclusion Strategy 2025-2028,Fourth Medium Term Plan for Financial Services Sector 2023-2027 and Signing of the Women Entrepreneurs Finance Code;

The Central Bank of Kenya (CBK) announces the launch of the National Financial Inclusion Strategy (NFIS) 2025-2028, the Fourth Medium Term Plan (MTP IV) for Financial Services Sector; and the signing of Women Entrepreneurs (WE) Finance Code on December 4, 2025.

The three policy frameworks provide strong foundation for transformation of Kenya’s financial sector landscape.

The three policy frameworks provide strong foundation for transformation of Kenya’s financial sector landscape.

The NFIS 2025-2028 seeks to enhance equitable access to, and usage of, quality and affordable financial products and services (payment,credit, insurance, pension, savings and investment) delivered in a sustainable way to match customer needs.

Development of the NFIS benefited from a wide range of stakeholders, local and foreign, as well substantial feedback from public participation process.

Development of the NFIS benefited from a wide range of stakeholders, local and foreign, as well substantial feedback from public participation process.

This NFIS provides a platform for close collaboration, coordination, and cooperation among stakeholders; seeks to minimise

duplication of efforts among various players and ensures efficient use of resources in undertaking financial inclusion initiatives.

The Strategy will also guide innovations, policies and initiatives by various stakeholders, for a coordinated approach in financial inclusion.

The Strategy will also guide innovations, policies and initiatives by various stakeholders, for a coordinated approach in financial inclusion.

It defines a broad range of financial services including payment, credit, insurance, pension, savings and investment; and ensure holistic measurement of financial inclusion across the four dimensions of access, usage, quality and impact.

The Strategy is organised into six pillars to address identified gaps for enhanced financial inclusion.

The Strategy is organised into six pillars to address identified gaps for enhanced financial inclusion.

These include the need to deepen penetration of access to financial services; enhancing usage of quality and affordable financial products; strengthening consumer protection and financial literacy; development of inclusive green finance; promotion of rural agriculture finance; and improved access to finance for women, youth, MSMEs, People with Disabilities, and Forcibly Displaced Persons.

It will be implemented through the National Financial Inclusion Council (NFIC) chaired by Principal Secretary (PS), The National

It will be implemented through the National Financial Inclusion Council (NFIC) chaired by Principal Secretary (PS), The National

Treasury (TNT), Technical Coordination Committee (TCC) chaired by the CBK Deputy Governor and supported by the NFIS Secretariat, Thematic Working Groups, and Financial Inclusion Advisory Groups.

The Fourth Medium Term Plan (MTP IV) for the Financial Services Sector 2023-2027 (MTP IV FSS) sets the overall framework and policy direction for the financial services sector.

The Fourth Medium Term Plan (MTP IV) for the Financial Services Sector 2023-2027 (MTP IV FSS) sets the overall framework and policy direction for the financial services sector.

It outlines key programmes and projects, including reform initiatives, for implementation over the five-year period. The MTP IV FSS recognises the role of the financial sector in supporting Kenya’s longer-term development aspirations as enshrined in Vision 2030.

Once fully implemented, the Plan is expected to position Kenya as a global and regional financial hub and increase financial services sector contribution to GDP.

Once fully implemented, the Plan is expected to position Kenya as a global and regional financial hub and increase financial services sector contribution to GDP.

This is to be achieved through deepening access to formal finance by underserved groups across the country, including Micro, Small and Medium Enterprises (MSMEs), women, youth and persons with disability (PWDs).

It also aims to respond to emerging issues such as climate change and evolving digital landscape such as virtual assets and virtual assets service providers.

It also aims to respond to emerging issues such as climate change and evolving digital landscape such as virtual assets and virtual assets service providers.

The MTP IV FSS goals include deepening access to all financial services; enhancing efficiency, stability and integrity in the financial sector; promoting financial literacy and consumer protection; and mobilizing higher levels of savings and investments.

This requires policy, legal and regulatory reforms, across the Insurance Policy; National Credit Information Sharing Policy; Macroprudential Policy; Unclaimed Financial Assets Policy; Disaster Risk Financing Strategy; Review of sub-sector legal frameworks; and the establishment of the Kenya Credit Guarantee Company.

This requires policy, legal and regulatory reforms, across the Insurance Policy; National Credit Information Sharing Policy; Macroprudential Policy; Unclaimed Financial Assets Policy; Disaster Risk Financing Strategy; Review of sub-sector legal frameworks; and the establishment of the Kenya Credit Guarantee Company.

Another important milestone for the country’s financial inclusion vision is the signing of Women Entrepreneurs (WE) Finance Code, a multi-stakeholder initiative to expand the number and type of institutions around the world working to close the financing gap for

women entrepreneurs.

The Code under the National Champion, CBK Deputy Governor, Dr. Susan Koech, provides a platform for financial sector leaders at all levels to prompt action inside and outside of their organizations to support and close financing gaps for women entrepreneurs. It systematises the collection, analysis and use of supply-side data on financing of women-led enterprises at

The Code under the National Champion, CBK Deputy Governor, Dr. Susan Koech, provides a platform for financial sector leaders at all levels to prompt action inside and outside of their organizations to support and close financing gaps for women entrepreneurs. It systematises the collection, analysis and use of supply-side data on financing of women-led enterprises at

the country level and globally.

It catalyses new financial and non-financial mechanisms to meet the needs of Women-led MSMEs and mobilises capital, improving standards, policies and regulations to address data gaps and financing constraints. More than forty (40) institutions have signed the Code and commit themselves to achieving its set objectives.

The launch of this NFIS alongside MTP IV FSS and WE Finance Code are expected to consolidate the gains made and leverage technology, data and synergy among stakeholders to harness emerging opportunities for a more inclusive, stable and sustainable financial sector to

serve many generations to come.

CBK will play pivotal role among other stakeholders to ensure successful implementation of these transformative frameworks for our financial sector.