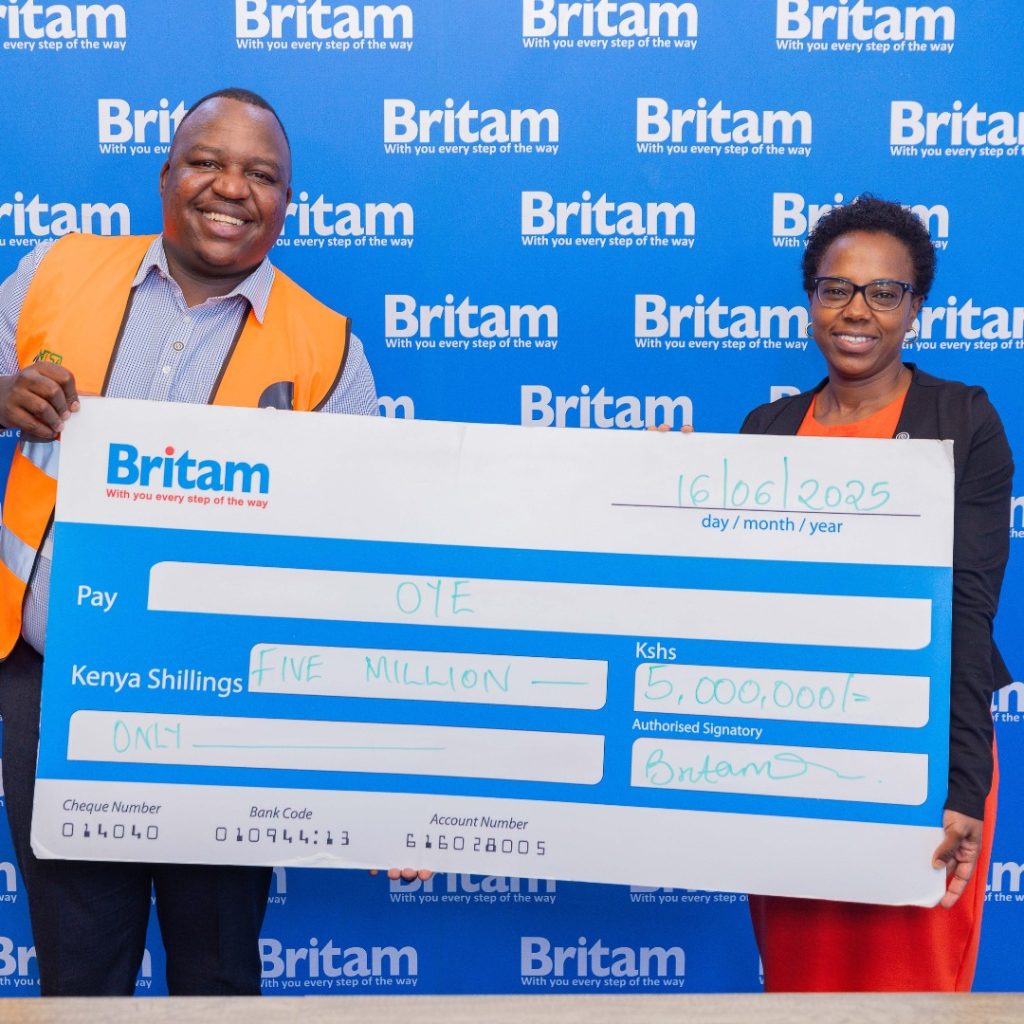

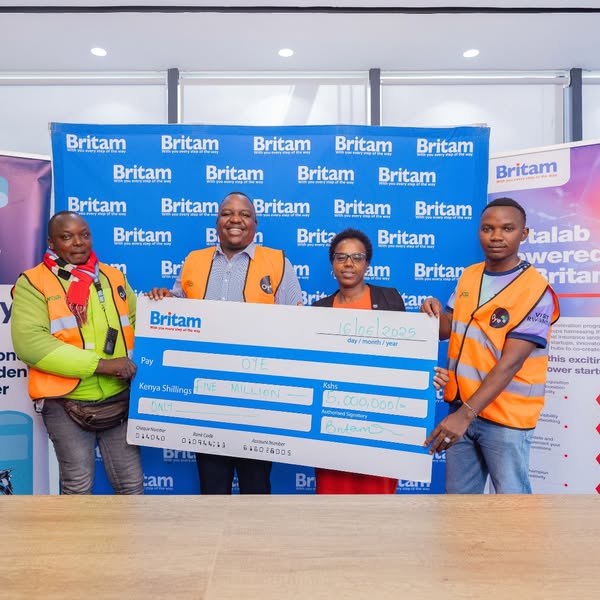

- BetaLab invests sh 5M in Oye to empower Boda Boda riders;

Britam’s innovation hub, BetaLab, has invested sh 5 million in Oye, a Kenyan fintech, to expand insurance access and help two million boda boda riders manage fuel costs.

Oye was founded in 2021 by Nairobi entrepreneur Kevin Mutiso, who built it on a simple yet powerful model, loyalty points that unlock insurance benefits.

Oye was founded in 2021 by Nairobi entrepreneur Kevin Mutiso, who built it on a simple yet powerful model, loyalty points that unlock insurance benefits.

Since its launch, the platform has issued over 20,000 insurance covers and successfully processed 45 claims, offering a financial safety net to one of Kenya’s most vulnerable and vital sectors.

Oye is deliberately inclusive, using USSD technology to serve boda riders without smartphones or internet access.

Oye is deliberately inclusive, using USSD technology to serve boda riders without smartphones or internet access.

Once registered, riders earn points for purchases made at partner merchants, and once they reach 90 points, they automatically qualify for insurance cover.

The platform’s real-time data system ensures efficient claims processing and targeted boda driver support.

The platform’s real-time data system ensures efficient claims processing and targeted boda driver support.

Britam’s Personal Accident Cover will now be embedded directly into the Oye platform, offering riders a seamless safety net in the event of illness or injury.

Meanwhile, “Songa Na Oye” will allow them to purchase fuel on credit and repay gradually creating more room for day-to-day operations without the pressure of upfront fuel costs.

Evah Kimani, Director of Partnerships and Digital at Britam, said this collaboration is a reflection of Britam’s focus on inclusive innovation.

Evah Kimani, Director of Partnerships and Digital at Britam, said this collaboration is a reflection of Britam’s focus on inclusive innovation.

“Oye’s model is simple, scalable, and designed around the needs of daily income earners. BetaLab is proud to help take it to the next level,” Kimani said.

Kevin Mutiso, CEO and Co-founder of Oye, noted that this investment is more than just financial backing; it’s a belief in a local solution designed for Kenyan realities by Kenyan entrepreneurs.

“With Britam on board, we’re not only expanding reach, but we’re also deepening impact,” Mutiso said.

“With Britam on board, we’re not only expanding reach, but we’re also deepening impact,” Mutiso said.

The investment also cements Oye as a key distribution partner for Britam’s microinsurance and financial wellness products, proving that corporates can scale innovation by lifting grassroots tech solutions that solve real-life problems.

Britam has consistently worked to expand access to affordable, flexible insurance solutions for underserved communities.

Britam has consistently worked to expand access to affordable, flexible insurance solutions for underserved communities.

Through its microinsurance offerings, it now covers over 4 million lives, making Britam Kenya’s largest provider in this space, with over 40 percent market share.