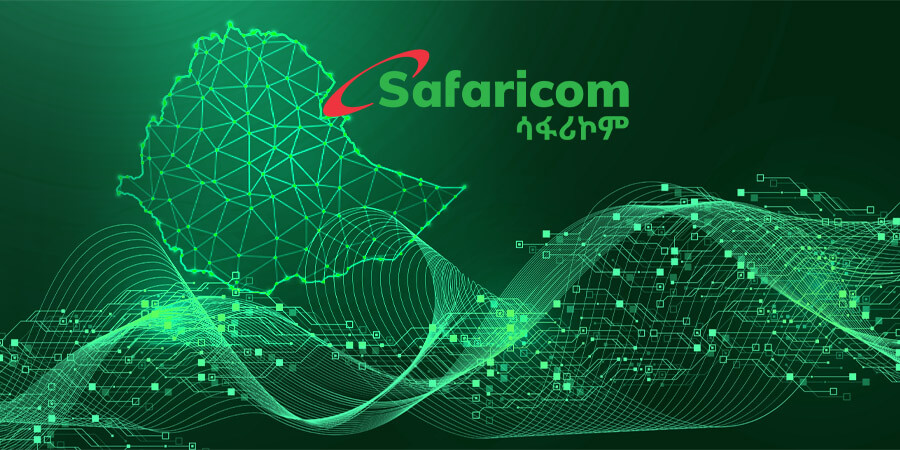

- Standard Bank and Safaricom Telecommunications Announce USD 138 Million Partnership to Expand Network Access;

Standard Bank (Trading as Stanbic in Kenya), Africa’s biggest bank by assets, has partnered with Safaricom Telecommunications, Kenya’s largest telecommunications provider, to provide funding of USD138 million (approximately KES 17.94 billion) as part of investment towards Safaricom Telecommunications Ethiopia PLC, STEP.

The bank acted as the sole arranger, lender, and facility agent on the term facility to STEP and played an advisory role. Standard Bank’s financing facilitates Safaricom’s ongoing rollout of digital infrastructure and services in Ethiopia.

The bank acted as the sole arranger, lender, and facility agent on the term facility to STEP and played an advisory role. Standard Bank’s financing facilitates Safaricom’s ongoing rollout of digital infrastructure and services in Ethiopia.

Dr Joshua Oigara, Regional Chief Executive for East Africa, Standard Bank Group, said, “This partnership reflects our commitment to enabling sustainable growth across the region.

By supporting the expansion of digital connectivity in Ethiopia, we are strengthening economic linkages, opening new opportunities for businesses and communities, and contributing to the advancement of East Africa’s digital economy.”

Anthony Ndegwa, Executive Vice President for Telecoms, Media and Technology at Stanbic Kenya’s Corporate and Investment Banking, said, “We are honoured to have partnered with Safaricom again in enabling and supporting their ongoing vision to drive digital transformation and inclusion in Ethiopia.”

Anthony Ndegwa, Executive Vice President for Telecoms, Media and Technology at Stanbic Kenya’s Corporate and Investment Banking, said, “We are honoured to have partnered with Safaricom again in enabling and supporting their ongoing vision to drive digital transformation and inclusion in Ethiopia.”

The two businesses worked side by side in the development of the financial solutions that were bespoke to the business while responsive to the market’s needs.

Peter Ndegwa, Safaricom Plc Chief Executive Officer, said, “As a business, we are guided by innovation and strategic partnerships.

We aim to transform lives at scale, empowering youth, entrepreneurs, and underserved communities to fully participate in Ethiopia’s digital economy and realise the promise of shared prosperity by 2030.”

“Through this partnership we are given the opportunity to pursue this goal and grow further to digitally enable Africa,” added Ndegwa.

The telecommunication company acquired licence to operate in Ethiopia in 2021, and Standard Bank was one of the advisors and financiers who worked with them as they deployed services and built the network in the country.

The telecommunication company acquired licence to operate in Ethiopia in 2021, and Standard Bank was one of the advisors and financiers who worked with them as they deployed services and built the network in the country.

The government of Ethiopia has also been deliberate in growing their economy through adaptation of regulations which has resulted in a significant growth in the uptake of internet.

According to the World Bank report, Empowering Ethiopians by Laying the Digital Foundations for Economic Growth, between 2020 and 2024, at least 4 million more people gained internet access, increasing coverage from 15 to 19 percent of the population.

According to the World Bank report, Empowering Ethiopians by Laying the Digital Foundations for Economic Growth, between 2020 and 2024, at least 4 million more people gained internet access, increasing coverage from 15 to 19 percent of the population.

Although each of the new mobile users has access to broadband internet, not all use data, so 4 million is a minimum estimate for new internet users.

Safaricom recently announced 10.1 million three-month active customers, after only being in the Ethiopian market for four years.

Safaricom recently announced 10.1 million three-month active customers, after only being in the Ethiopian market for four years.

“As a bank we are dedicated in partnering with relevant parties to drive infrastructure development that will help accelerate the growth of the continent’s economy.

Digital and financial inclusion in the African market has been one of the key objectives to break barriers and enabling individuals, communities and businesses to access affordable financial products and services that meet their needs,” says Taitu Wondwosen, Head of Standard Bank in Ethiopia.

Digital and financial inclusion in the African market has been one of the key objectives to break barriers and enabling individuals, communities and businesses to access affordable financial products and services that meet their needs,” says Taitu Wondwosen, Head of Standard Bank in Ethiopia.

“This partnership demonstrates the power of regional collaboration in unlocking long term value. Standard Bank remains committed to enabling growth across the region through sustainable investment,” adds Dr. Joshua Oigara, Regional Chief Executive for Stanbic Bank.

“This partnership demonstrates the power of regional collaboration in unlocking long term value. Standard Bank remains committed to enabling growth across the region through sustainable investment,” adds Dr. Joshua Oigara, Regional Chief Executive for Stanbic Bank.